charitable gift annuity example

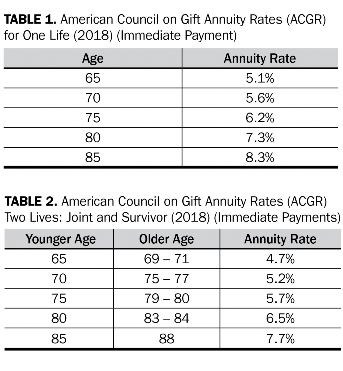

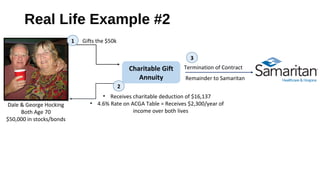

They donate 50000 in cash to Hadassah to establish a two-life charitable gift annuity. The minimum contribution to form a CGA is 25000 for individuals 60 years or older.

Cga Program Best Practices You Need To Know A Review Of The Acga Cgp Cga Survey

Also part of their 100000 is a charitable gift and therefore the Richards.

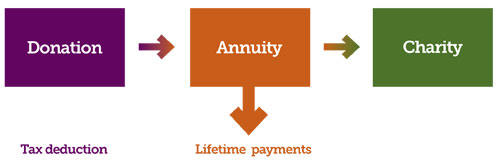

. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. An Example of How It Works. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation.

Dennis 75 and Mary 73 want to make a. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation.

A charitable remainder annuity trust CRAT is an option for estate planning. Based on current calculations 380600 of the 5500 annual income will be free from income tax for 164 years. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation.

Charitable Gift Annuities An Example. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. Based on their ages they will receive a payout rate of 59 percent 2950 each year for life and are also.

Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. Charitable Gift Annuities An Example. Charitable Gift Annuities An Example.

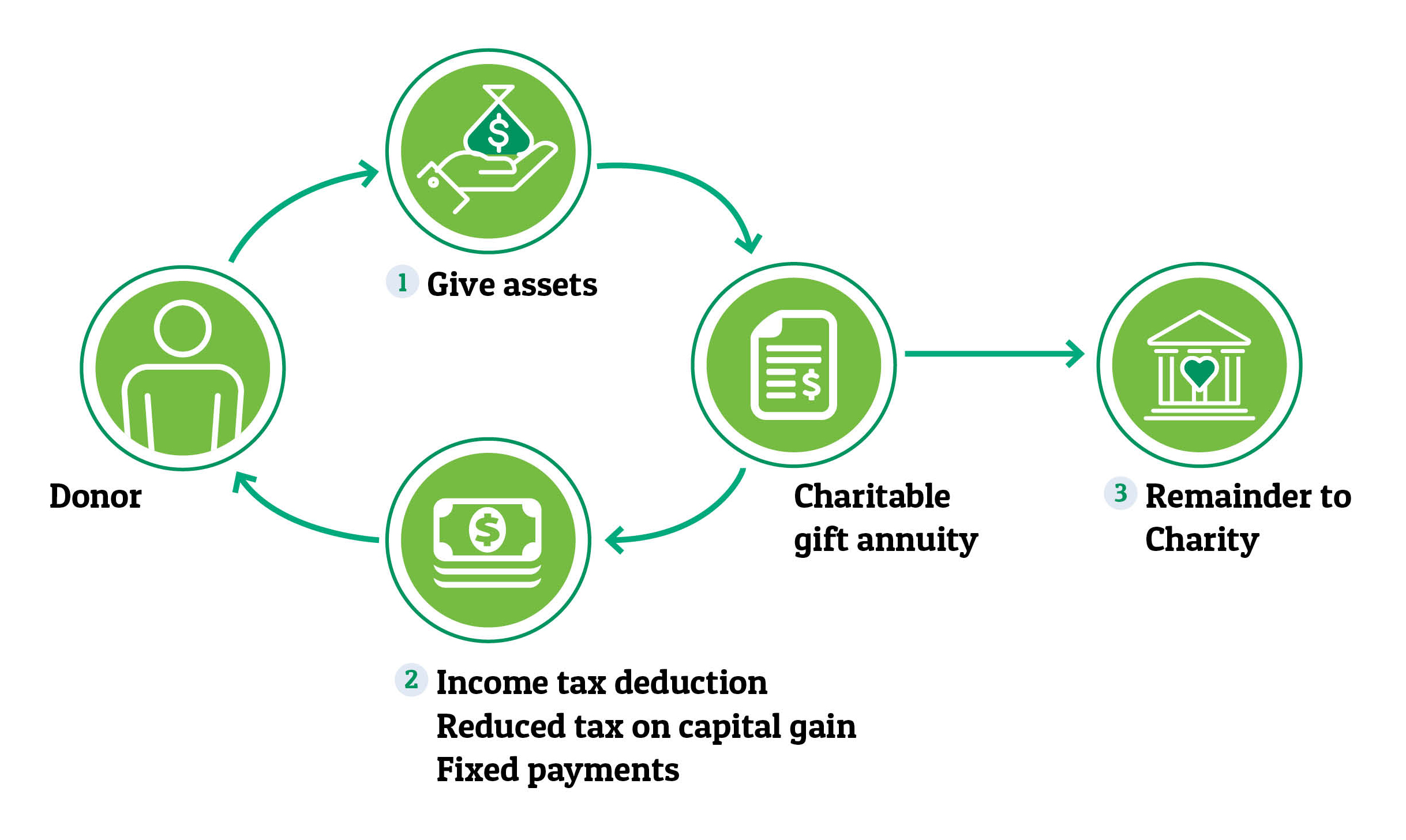

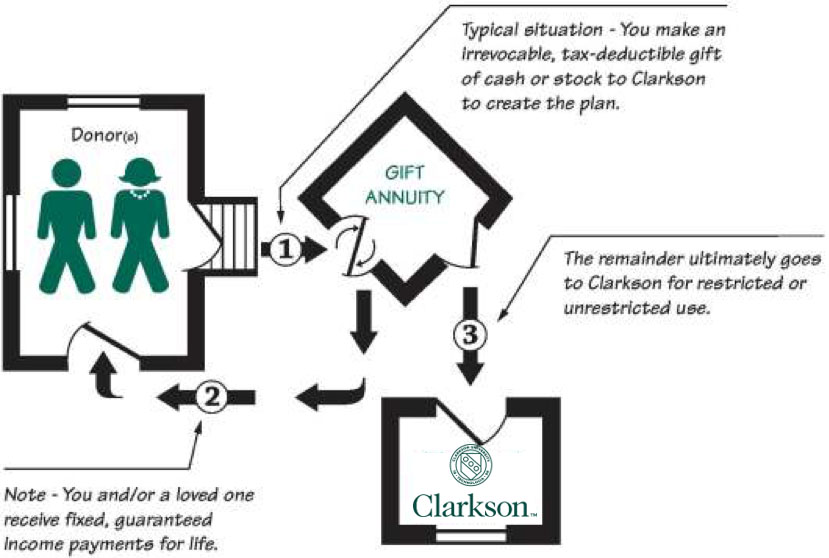

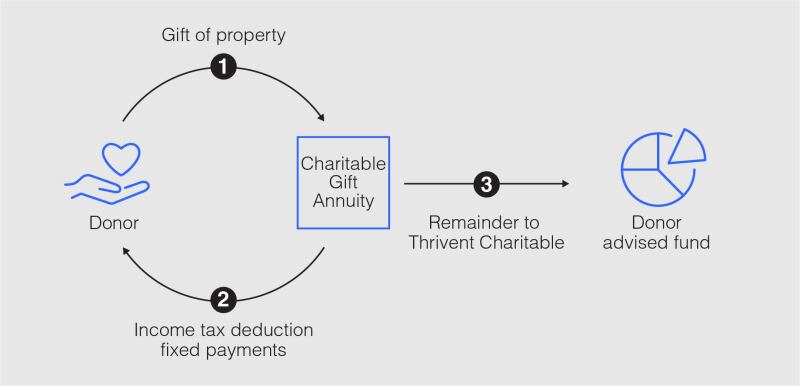

A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. Charitable Gift Annuities An Example.

We understand that you may be interested in a. Charitable Gift Annuities An Example. Charitable gift annuity donors annuitants receive payments for the rest of their lives.

Charitable Gift Annuities An Example. In addition to these fixed annuity payments you receive a charitable tax-deduction in the year you make. Charitable Gift Annuities An Example.

Because our donor itemizes their tax deductions they earn a federal income tax charitable deduction of 12045 the amount of the 25000 donation. Charitable Gift Annuities An Example. The size of your payment is determined by many factors including.

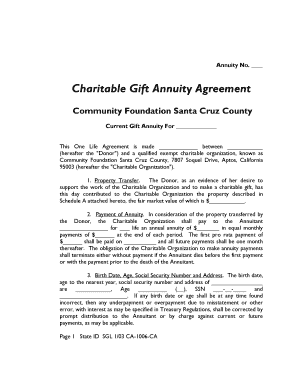

The following is a sample disclosure for a charity to consider using based upon advice and guidance from its own legal counsel. A charitable gift annuity example. A charitable gift annuity is a gift vehicle that falls in the category of planned giving.

It involves a contract between a donor and a charity whereby the donor transfers cash or property to the. This type of trust is a financial arrangement that allows a trustee to hold assets for one or more. Simply input the amount of your possible gift the basis of the property and the.

Charitable gift annuity payments. A charitable gift annuity allows you to support Temple University and receive payments in your retirement years. Charitable Gift Annuities An Example.

After Anns death the balance of the invested funds will go to her favorite qualifying charities including a local animal shelter. The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators. Charitable Gift Annuity.

As with any other.

Charitable Gifts Archdiocese Of New York

Msu Extension Montana State University

Charitable Gift Annuities Hampshire College

For Individual Members Gift Planning Options Annuities

Gift Agreement Template Fill Online Printable Fillable Blank Pdffiller

Giving To Tulane New Charitable Gift Annuity Rates

Gift Annuities Uc Santa Barbara

Charitable Gift Annuities Development Alumni Relations

Charitable Gift Annuities Barnabas Foundation

Charitable Gift Annuity Rates On The Rise Don T Miss This Opportunity To Make A Difference University Of Maine Foundation

Charitable Gift Annuity Rate Increases Texas A M Foundation

Annuities The Catholic Foundation

Charitable Gift Annuities Giving To Stanford

Charitable Gift Annuities University Of Montana Foundation University Of Montana

What Is A Charitable Gift Annuity Thrivent

What Is A Charitable Gift Annuity

The Weird Math Of Charitable Gift Annuities Retirement Income Journal